Tax Prep: 6 Ways to Get a Head Start on Tax Season

Oct 22, 2018 • Written by Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Blog Home » Asset Allocation » Tax Prep: 6 Ways to Get a Head Start on Tax Season

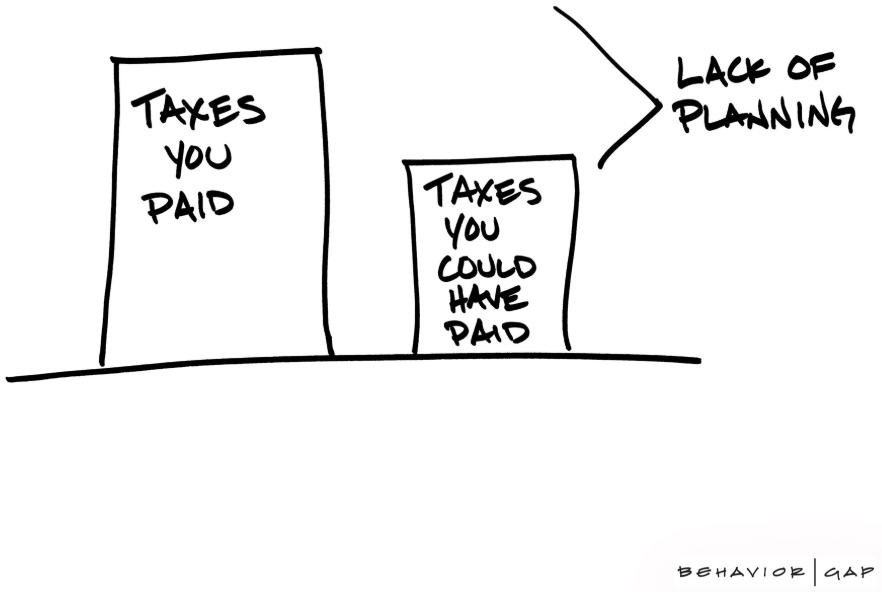

Tax filing season may be months away, but it’s never too early to get organized. Consider taking these simple steps to prepare before the end of the year – and potentially minimize your tax bill.

Tax filing season may be months away, but it’s never too early to get organized. Consider taking these simple steps to prepare before the end of the year – and potentially minimize your tax bill.

Double-check your withholding and estimated tax payments: With the recent tax law changes from the Tax Cuts and Jobs Act (TCJA), it’s more important than ever to review your withholding and estimated tax payments. Many people think getting a big tax refund is a good thing. Unfortunately, the IRS does not pay you interest on the refund it sends you. Having too much money withheld from your paycheck – or overpaying your quarterly estimated tax payments – means you’re forgoing the potential interest or returns that money could have generated. On the other hand, withholding too little can lead to a large bill at tax time, an unpleasant surprise if you haven’t planned for it. Both scenarios can be avoided by ensuring that your withholding is appropriate.

Contribute to your retirement account: Even though you have until year-end to make contributions to your 401(k) or Tax Day (April 15) for your traditional or Roth IRA, making early contributions will give your money more time to benefit from potential long-term compound growth. Consider making your 2018 contribution now.

Take required minimum distributions (RMDs): If you’re age 70½ or older and have to take RMDs from your retirement accounts, you must do so before the end of the year; otherwise, you may have to pay a 50% excise tax on the amount not distributed. If you turned 70½ this year, you have until April 1 of next year to take your first RMD. However, if you wait until next year to start, you will have two distributions in the same year – which might bump you into a higher marginal tax bracket.

If you’re charitably inclined, consider making a qualified charitable distribution (QCD) from your retirement account directly to your favorite charity. You can use a QCD to donate up to $100,000 a year and it won’t be included in your income.

Know your costs before you sell: Savvy investors know that managing cost basis can help them save on taxes. Your cost basis is essentially what you paid for an investment, including brokerage fees and any other trading costs. Your capital gain (or loss) will be the difference between the cost basis of the asset and the price at which you sell it. In a simple transaction, the cost basis should be easy to calculate.

However, if you buy the same investment over time – such as through a dividend reinvestment plan – each block of shares purchased is likely to have a different cost and holding period. In these situations, you can pick which shares to sell, giving you the ability to sell the ones that will have the least tax impact. Alternatively, you can go with the default method, which requires zero effort or calculation on your part – but could cost you more in taxes.

Invest tax-efficiently: Make sure your assets are located in the most tax-efficient investment accounts. For example, it makes sense to hold long-term investments in a taxable account, because any gains will be taxed at the lower capital gains rate. The same is true for tax-efficient investments, such as stocks or funds that pay qualified dividends, municipal bonds, and most index funds and ETFs.

On the other hand, you’re better off holding short-term investments in tax-advantaged accounts, such as a 401(k) or IRA. Remember, gains on short-term investments are taxed as ordinary income, which is subject to a higher tax rate than capital gains. The same is true for actively managed mutual funds that may generate significant short-term capital gains or the interest income on bonds.

Qualified withdrawals from Roth IRAs and Roth 401(k)s are tax-free, so it usually makes sense to use these accounts for assets that you expect will appreciate the most. Of course, tax-efficient placement presumes you have different account types. If most or all of your portfolio is in tax-deferred accounts, you’ll want to focus on your asset allocation strategy.

Maximize your charitable giving: If the recent changes to the tax law make the standard deduction the best option for you, consider concentrating your donations into a single year. By giving more in one year, you can maximize your itemized deduction for that year. The next year, you can switch and take the standard deduction. By alternating the years you give, you could have an increased deduction over that two-year period.

In addition, if you were planning on selling a significant amount of appreciated stock – which will generate a large taxable gain – consider donating a portion of those assets directly to a charity. You’ll get a tax deduction for the full fair market value of the donated stock and you won’t have to pay taxes on the gain for those shares.

Many charities are unable to accept gifts of appreciated assets, like stocks, but you can use a donor-advised fund, which is another great tax tool to facilitate the donation process. When you place assets in a donor-advised fund, you get the full deduction for the charitable gift that year. Then, you can grant those assets to your favorite charity over time.

These are just a few of the steps you can take to prepare for tax season and potentially minimize your tax bill. A qualified tax professional can help you find other effective ways to navigate tax season, given your personal situation.

After you decide what to do this year, resolve to make financial planning a year-round exercise. By looking ahead, you’ll find it easier to check your progress, update your plan and, if necessary, take action long before the tax-filing deadline.

Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Paul Staib, Certified Financial Planner (CFP®), RICP®, is an independent Flat Fee-Only financial planner. Staib Financial Planning, LLC provides comprehensive financial planning, retirement planning, and investment management services to help clients in all financial situations achieve their personal financial goals. Staib Financial Planning, LLC serves clients as a fiduciary and never earns a commission of any kind. Our offices are located in the south Denver metro area, enabling us to conveniently serve clients in Highlands Ranch, Littleton, Lone Tree, Aurora, Parker, Denver Tech Center, Centennial, Castle Pines and surrounding communities. We also offer our services virtually.

Read Next

What You Can Learn From Your 1099 Tax Forms

• Written By Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

The first thing to know about 1099s is that there are several different subtypes: 1099-DIV, 1099-INT, 1099-R, 1099-MISC, and so…

Conducting a Mid-Year Investment Portfolio Checkup? Avoid These Mistakes

• Written By Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

When it comes to checking up on your portfolio, a policy of benign neglect invariably beats too much monitoring. Investors…